Behavioral Banking

Influence

Your Customers’

Millennials'

Early Adopters'

Cat Peoples'

Students’

Retirees’

First Home Buyers’

Lightsaber Owners’

Mobile Users ‘

Late Adopters’

Humans’

Financial Decision Making

Exagens Behavioral Banking Solutions

increase engagement and results by combining:

Human

- Behavioral Economics

- Psycholinguistics

- Human Psychology

Technology

- Artificial Intelligence

- Data Analytics

- Machine Learning

Communication

- Proactive

- Individualized

- Empathetic

What We Do

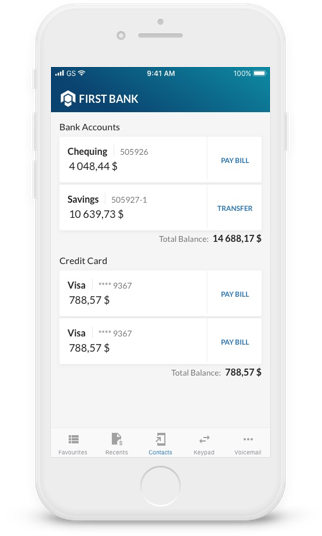

Digital Sales

Increase Conversion

- Influence Behavior

- Cross-Sell and Up-Sell

- Build a Habit

Digital Adoption

Ensure Full Usage

- Promote Usage of Digital Tools

- Relational Interactions

- Nudge Users Forward

Digital Engagement

Increase Customer Satisfaction

- Increase Channel Usage

- Behavioral Financial Insights

- Improve Customer Experience

What is Behavioral Banking?

Behavioral Banking: Driving Smarter Financial Choices and Growth

Behavioral Banking blends behavioral science, AI, and data intelligence to deliver individualized tips, insights, and advice helping people save, spend, borrow, and invest smarter with your financial institution.

With every interaction, you strengthen and expand relationships and catalyze your institution and your users to grow financially - Together

- Empower people with actionable, individualized guidance

- Catalyze people to take action, not just consume information

- Strengthen engagement and loyalty

- Grow your institution while supporting financial well-being

Why It Matters

Grow Financial Wellness & Deepen Individual Relationships

Individualized Guidance

Deliver timely, relevant financial tips which resonate and can be acted upon.

Stronger Engagement

Turn passive consumers of content into emotionally engaged participants catalyzed to take action.

Institutional Growth

Drive deposits, lending, increased card use and loyalty while boosting the financial well-being of the people you serve.

Ready to Empower the People and Communities You Serve?

Discover how exagens and Behavioral Banking can help your institution grow while supporting the financial well-being of the people and communities you serve so you all grow together.

Latest News